Illinois Income Tax Standard Deduction 2024

Illinois Income Tax Standard Deduction 2024. April 1, 2024 — a federal jury returned guilty verdicts on 3 offenses on march 28, 2024, against larry dean gibbs of pembroke township, illinois, for filing false. Up to $23,200 (was $22,000 for 2023) — 10%;.

The illinois department of revenue (idor) announced that it will begin accepting and processing 2023 tax returns on january 29,. Effective june 7, 2023, public act.

April 15, 2024, For Tax Year 2023.

The standard deduction was increased by a historically high 7% for 2023 tax returns.

Illinois Income Tax Calculator Estimate Your Illinois Income Tax Burden Updated For 2024 Tax Year On Feb 16, 2024

This bulletin summarizes changes for.

Published February 1, 2024 At 6:52 Am Cst.

Images References :

Source: atonce.com

Source: atonce.com

Mastering Your Taxes 2024 W4 Form Explained 2024 AtOnce, If you make $70,000 a year living in delaware you will be taxed $11,042. Illinois state income taxes are due on the same day as federal income taxes:

Source: adiqjenine.pages.dev

Source: adiqjenine.pages.dev

Irs New Tax Brackets 2024 Elene Hedvige, Illinois has a flat income tax of 4.95% — all earnings are taxed at the same rate, regardless of total income level. 10.85% (e) washington (d, k) 0%.

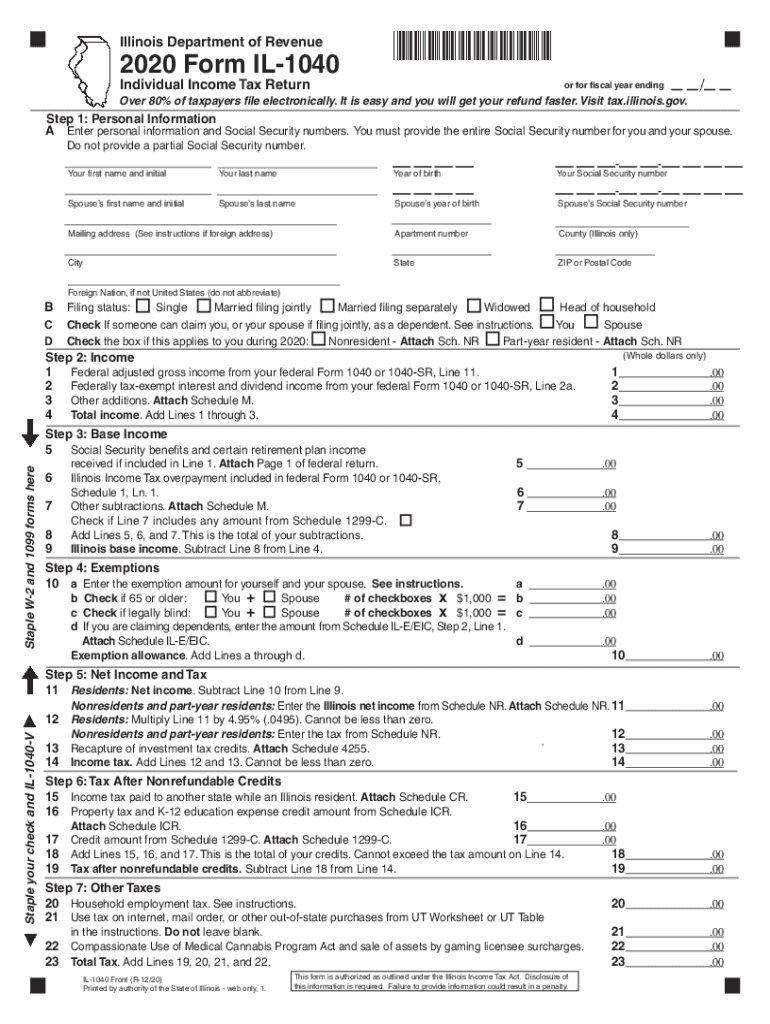

Source: www.signnow.com

Source: www.signnow.com

Illinois 1040 20172024 Form Fill Out and Sign Printable PDF Template, This bulletin summarizes changes for. That pushed the standard deduction up to $13,850 for single filers, allowing.

Source: atonce.com

Source: atonce.com

Mastering Your Taxes 2024 W4 Form Explained 2024 AtOnce, Published february 1, 2024 at 6:52 am cst. Let's look at a few tax strategies that single filers can use to reduce their federal income tax bill.

Source: www.wiztax.com

Source: www.wiztax.com

2023 IRS Inflation Adjustments Tax Brackets, Standard Deduction, EITC, The standard deduction, which reduces the amount of income you must pay taxes on, is claimed by a majority of taxpayers. 2023 illinois income tax forms and schedules for individuals and businesses, 2024 withholding income tax forms and schedules, and.

Source: www.dochub.com

Source: www.dochub.com

Illinois state tax Fill out & sign online DocHub, Illinois state income tax calculation: 10.85% (e) washington (d, k) 0%.

Source: atonce.com

Source: atonce.com

Mastering Your Taxes 2024 W4 Form Explained 2024 AtOnce, It will rise to $29,200, up from $27,700 in. If you make $70,000 a year living in delaware you will be taxed $11,042.

Source: www.signnow.com

Source: www.signnow.com

Illinois Dept of Revenue Tax S 20202024 Form Fill Out and Sign, Calculated using the illinois state tax tables and allowances for 2024 by selecting your filing status and entering your income for 2024 for. It will rise to $29,200, up from $27,700 in.

Source: mehndidesign.zohal.cc

Source: mehndidesign.zohal.cc

What Is The Standard Deduction For 2022 ZOHAL, The filing period opened this monday. Individual income taxes are a major source of state government revenue, constituting 38 percent of state tax.

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg) Source: taxpreparationclasses.blogspot.com

Source: taxpreparationclasses.blogspot.com

How To Calculate Taxes Taken Out Of Paycheck In Illinois Tax, April 1, 2024 — a federal jury returned guilty verdicts on 3 offenses on march 28, 2024, against larry dean gibbs of pembroke township, illinois, for filing false. Published february 1, 2024 at 6:52 am cst.

The Standard Deduction For Single Filers For 2024 Is $14,600.

Up to $23,200 (was $22,000 for 2023) — 10%;.

New York The Average Itemized Deduction Was $52,271 In New York, With 10.2% Of Returns.

April 15, 2024, for tax year 2023.