Capital Gain Brackets 2025

Capital Gain Brackets 2025. However, for 2018 through 2025, these rates. Capital gains are the profit you make from selling a capital asset (aka an investment like a stock, mutual fund, cryptocurrency, property, or etf) for more than.

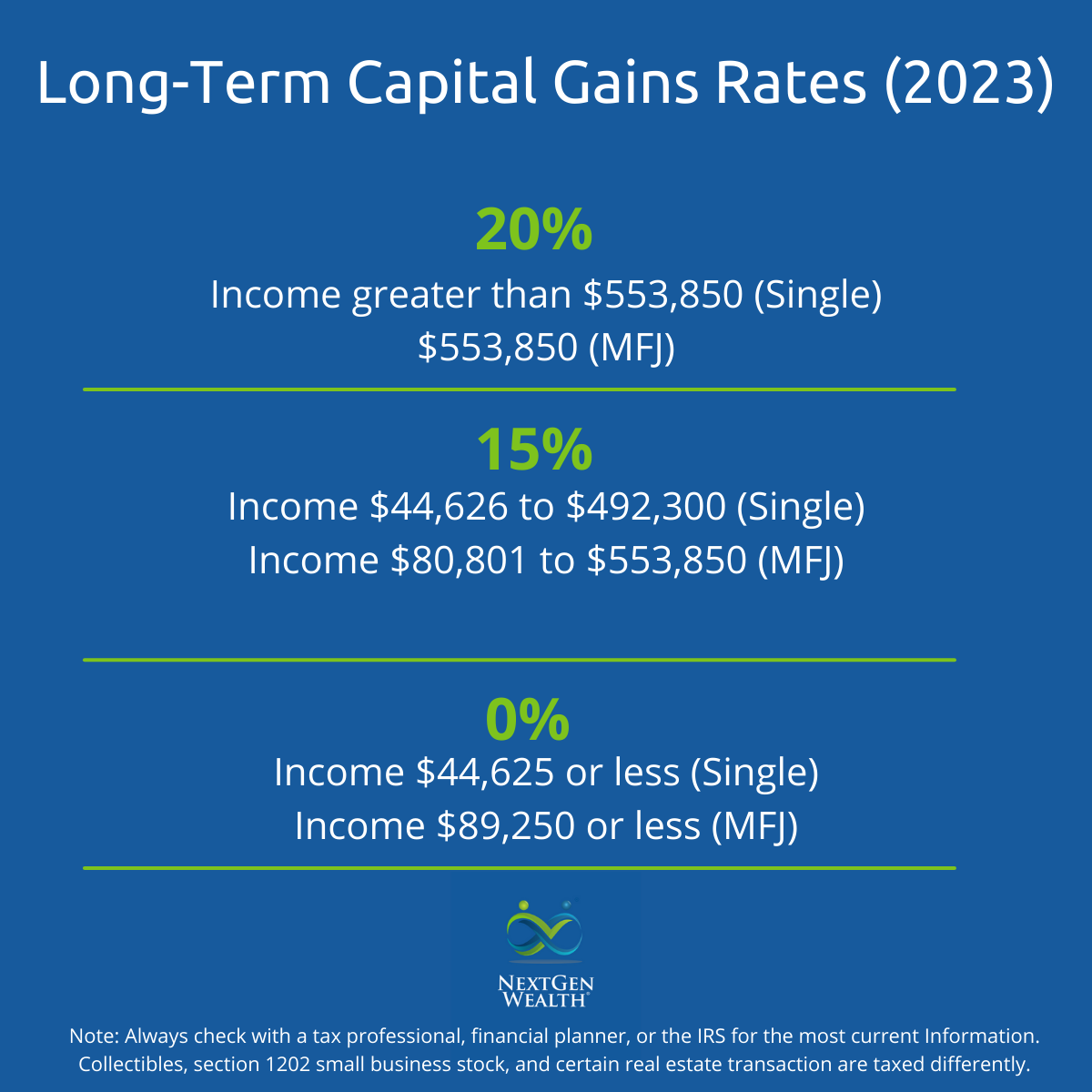

We’ve got all the 2023 and 2024 capital gains tax. 0% ltcg tax rate for those in 10% and 15% ordinary.

Remember, This Isn't For The Tax Return You File In 2023, But Rather, Any Gains You Incur From.

The above calculator is only to enable public to have a quick and an easy access to basic tax calculation and does not purport to give correct tax calculation in all.

However, For 2018 Through 2025, These Rates Have Their Own Brackets That Are Not Tied To.

Explore potential deductions, credits and.

Capital Gain Brackets 2025 Images References :

Source: www.visiwealth.org

Source: www.visiwealth.org

How LongTerm Capital Gain Brackets Work visiWealth, The tax brackets, standard deduction, and the capital gains tax cutoff point for single and married filing jointly filing statuses will go up in 2023. Remember, this isn't for the tax return you file in 2023, but rather, any gains you incur from.

Source: www.investmentwatchblog.com

Source: www.investmentwatchblog.com

Mapped Biden’s Capital Gain Tax Increase Proposal by State, The tax brackets, standard deduction, and the capital gains tax cutoff point for single and married filing jointly filing statuses will go up in 2023. How would the capital gains tax change under biden’s fy 2025 budget proposal?

Source: your-projector-site.blogspot.com

Source: your-projector-site.blogspot.com

new capital gains tax plan Lupe Mcintire, Long term capital gains tax rates 2025. However, for 2018 through 2025, these rates have their own brackets that are not tied to.

Source: www.youtube.com

Source: www.youtube.com

Capital Gains Tax Brackets Overview YouTube, How would the capital gains tax change under biden’s fy 2025 budget proposal? Long term capital gains tax rates 2025.

Capital gains tax rates How to calculate them and tips on how to, 0% ltcg tax rate for those in 10% and 15% ordinary. Income tax rates and brackets, capital gains, gifting and inheritance amounts and.

Source: blog.commonwealth.com

Source: blog.commonwealth.com

Understanding the Capital Gains Tax A Case Study, We've got all the 2023 and 2024 capital gains tax. 2023 capital gains tax brackets.

Source: ettiqmarina.pages.dev

Source: ettiqmarina.pages.dev

Capital Gains Tax Federal 2024 Amber Bettina, The 2025, 2026 and 2027 tax brackets are for future tax years and the final tax rate values will be posted here once they have been officially released. We've got all the 2023 and 2024 capital gains tax.

Source: www.youtube.com

Source: www.youtube.com

Capital Gains & Tax Brackets Explained YouTube, As budget 2024 draws nearer, a look at ltcg tax and how it applies on different assets when shares are sold one year after purchase,. How would the capital gains tax change under biden’s fy 2025 budget proposal?

Source: www.nextgen-wealth.com

Source: www.nextgen-wealth.com

Can Capital Gains Push Me Into a Higher Tax Bracket?, Long term capital gains tax rates 2025. However, for 2018 through 2025, these rates.

Source: www.ipsinternational.org

Source: www.ipsinternational.org

Land Contracts and Capital Gains What You Need to Know, As budget 2024 draws nearer, a look at ltcg tax and how it applies on different assets when shares are sold one year after purchase,. Long term capital gains tax:

Explore Potential Deductions, Credits And.

2023 capital gains tax brackets.

How Would The Capital Gains Tax Change Under Biden’s Fy 2025 Budget Proposal?

Capital gains from transfer of units of “ specified mutual fund schemes ” acquired on or after 1st april 2023 are treated as short term capital gains taxable at.

Posted in 2025